Job costing

According to CIMA, job costing is a form of specific order costing which applies where work is undertaken to customers` special requirements and each other is of comparatively short duration. The work is usually carried out under a roof or in a factory and moved through many processes and operations as a continuously identifiable unit.It is appropriate when production consists of special jobs rather than when products are standardized.

Features of job costing

- Each job is carried out to meet customer`s specific requirements.

- It is a specific order costing.

- Each job is given a unique number that identifies the job.

- the cost of each job is ascertained.

- standardization of controls is comparatively difficult.

Advantages of job costing

- It highlights the likely profitability of a job.

- It enables comparison to be made with performance on other jobs.

- The profit or loss of each job can be ascertained if cost is set against the price tended for the job.

- It enables generation of cost data useful for the analysis and control by the management.

Disadvantages of job costing

2. It is time consuming.

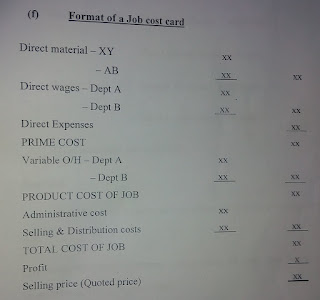

Format of Job cost sheet

Direct materials - XYZ xx

-ABC xx xx

Direct wages ---- department 1 xx

-department 2 xx xx

Direct expenses xx

PRIME COST xx

Variable overhead - dept. 1 xx

dept. 2 xx xx

PRODUCTION COST xx

Administrative cost xx

Selling & distribution cost xx xx

TOTAL COST OF JOB xx

profit xx

selling price or quoted price xx

The format can be found in the image below;

Batch Costing

According to CIMA, Batch costing is a form of specific order costing which applies where similar articles are manufactured in batches either for sale or for use within the undertaking. Batch cost is the aggregated costs relative to a cost unit which consists of a group of identical articles which maintains its identity throughout the stages of production.It follows the same procedures as job costing, with the batch constituting the unit.

When an organization receive many orders from different customers, there is high probability that there would be some are products that are common among orders, then the organization can use production orders for batches that consist of a predecided quantity of each type of product. The organization would adopt Batch costing method in such cases in order to find the cost of each order of such batch.

A unit cost can be ascertained by dividing the batch cost by the number of units in a batch;

Cost per unit = total cost of batch

number of units produced in the batch.

Illustration:

batch no x32 incurred some costs as follows:

Department A: 420 labour hours at $3.50

Department B: 686 hours at $3.00

Factory overhead are absorbed on labour hours and the rates are as follows:

Department A: $8/hour

Department B: $5/hour

The organization uses a cost plus system of costing for settling selling prices and expect a 25% gross profit(sales - factory cost).

Administrative overheads are absorbed as 10% selling price assuming that the organization produced 1000 units. You are required to:

- Find the selling price per unit.

- Find the total amount of Admin overhead recovered by Batch number x32.

- Calculate the notional net profit per unit.

$ $

Labour: department A (420 x 3.5) 1470

department B (686 x 3) 2058 3528

Factory overhead: department A 3360

department B 3430 6790

Total cost 65% 10318

Admin cost 10% 1587.38

Gross profit 25% 3968.46

Selling price for the batch 15873.84

(1) selling price per unit = total selling price / number of units produced

= 15874/1000 = $15.87

(2) total admin overhead recovered = Admin cost(10%) = $1587.40

(3) notional net profit per unit = 3968.46/1000 = $3.97

Nice

ReplyDeleteThanks

ReplyDelete